SOCIAL MEDIA NEWS

Netflix earnings Q2 2019

[ad_1]

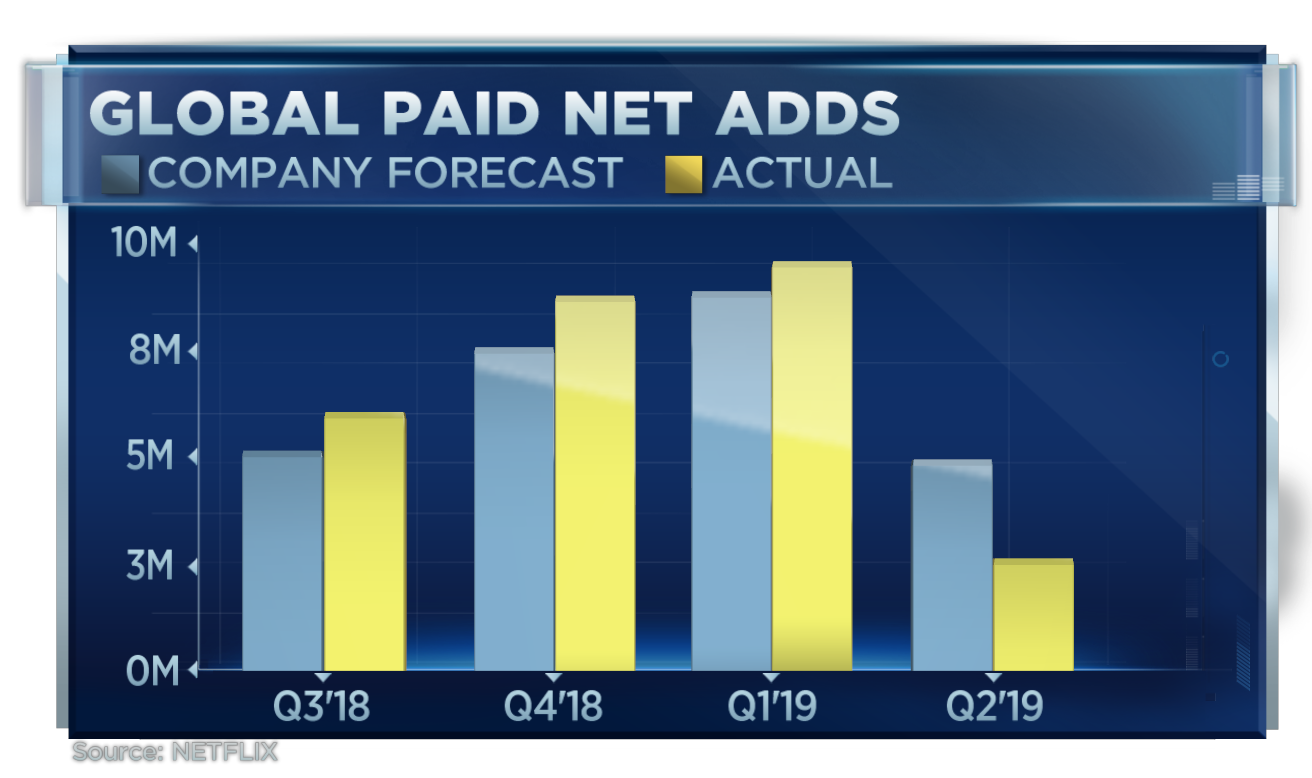

Shares of Netflix were down 12% Wednesday after the company released its earnings report for the second quarter. The results showed a rare loss in U.S. subscribers and a large miss on international subscriber adds.

Here are the key numbers:

- Earnings per share: 60 cents, vs. 56 cents expected, per Refinitiv consensus estimate

- Revenue: $4.92 billion vs. $4.93 billion expected, per Refinitiv

- Domestic paid subscriber additions: A loss of 126,000 vs. a gain of 352,000, forecast by FactSet

- International paid subscriber additions: 2.83 million vs. 4.81 million, forecast by FactSet

Netflix said in addition to its content slate, its first-quarter subscriber growth was so strong that “there may have been more pull-forward effect than we realized.” The company also said in its letter to shareholders that the missed forecast was most pronounced in regions that saw price increases.

However, Netflix is projecting a stronger third quarter on the heels of heavy viewership of the third season of “Stranger Things.” Netflix forecast 7 million global paid net adds for the next quarter and provided revenue guidance of $5.25 billion. The company expects subscriber numbers will be boosted by its strong content slate in the third quarter, including the final season of “Orange is the New Black” and a new season of “The Crown.”

Prior to the report, shares of Netflix were up more than 35% in 2019. The stock is now set to open Thursday at its lowest price since January, shaving $20 billion from its market cap and bringing it to about $138 billion.

Netflix acknowledged that it will soon lose two of its most-watched shows, “The Office” and “Friends.” NBCUniversal announced in June that it plans to remove “The Office” from Netflix in 2021 and move it to its own streaming service. Earlier this month, AT&T’s WarnerMedia announced its new streaming service, HBO Max, will include exclusive rights to stream “Friends” when it launches publicly in the spring of 2020. Netflix previously spent $80 million to keep “Friends” just through the end of this year, according to Vulture. Netflix said the loss of these shows is “freeing up budget for more original content.”

Even with the announcement of several new rival streaming services, Netflix told shareholders, “We don’t believe competition was a factor since there wasn’t a material change in the competitive landscape during Q2, and competitive intensity and our penetration varied across regions (while our over-forecast was in every region).”

Netflix said that its advertising-free model gives it an edge over several of the newer streaming entrants.

“We, like HBO, are advertising free,” the company wrote in its letter to shareholders. “That remains a deep part of our brand proposition; when you read speculation that we are moving into selling advertising, be confident that this is false. We believe we will have a more valuable business in the long term by staying out of competing for ad revenue and instead entirely focusing on competing for viewer satisfaction.”

While industry executives anticipate Netflix will someday have ads, a recent study found that 23% of respondents would definitely or probably drop their subscription if it began running ads at its current price or a dollar cheaper.

The company maintained its free cash flow forecast for the full year 2019 of negative $3.5 billion and “expect improvement in 2020.” Beyond 2020, Netflix expects to reduce its free cash flow deficit as it grows its member base, revenues and operating margins. Netflix previously said 2019 would be its peak year for cash burn. It later revised that statement to say its cash flow would be consistent with the negative $3 billion of the prior year.

Netflix plans to continue using high yield debt to fund content investment in the meantime, according to the shareholder letter. Netflix has twice offered $2 billion in debt since October. The company said it raised 10.5 year senior notes off €1.2 billion (3.875% coupon) and $900 million (5.375% coupon) in its latest round.

This story is developing. Check back for updates.

Disclosure: Comcast owns NBCUniversal, the parent company of CNBC and NBC.

Subscribe to CNBC on YouTube.

WATCH: Netflix’s DVD business is still alive and profitable — here’s what it looks like

[ad_2]

Source link