LATEST FINANCIAL NEWS

Stocks mixed ahead of US Fed decision

[ad_1]

The JSE recorded a relatively mixed trading

session on Wednesday as it struggled for momentum ahead of the United States

Fed’s interest rate decision.

The South African benchmark 10-year

Treasury yield pointed lower to reach a session low of 8.180% while the rand

traded mostly flat against the US dollar.

US Treasuries also slipped along with other

major global Treasury bond yield benchmarks. With the US Fed expected to strike

a more dovish tone in its latest policy statement, yields are falling on the

back of bets that the Fed could cut rates at its next policy meeting in July.

Initial estimates suggest that the Fed will

leave rates unchanged at 2.50% on Wednesday.

Locally, Statistics SA released South

Africa’s inflation data for the month of May.

CPI YoY was recorded at 4.5% which was

marginally higher than the prior recording of 4.4% but well within the SARB’s

target range of between of 3% and 6%. CPI MoM slowed down to 0.3% from a prior

recording of 0.6%.

The was limited reaction to this data in

the rand which remained range bound between R14.46/$ and R14.58/$ for the

duration of today’s session.

At 17:00, the rand was trading 0.11% weaker

at R14.52/$.

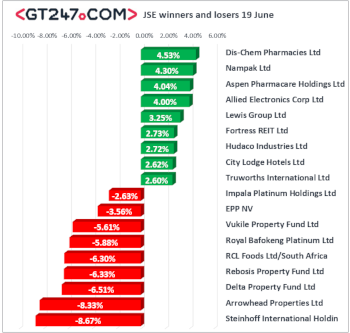

On the local bourse, Dis-Chem Pharmacies

[JSE:DCP] recorded another session of gains as it surged 4.53% to close at R27.01

as it finished amongst the day’s biggest gainers.

Nampak [JSE:NPK] advanced 4.3% to end the

day at R9.70, while cement maker PPC Limited [JSE:PPC] added 1.05% to close at

R4.80.

Some of the listed property stocks were

upbeat on the day as gains were recorded for Equities Property Fund [JSE:EQU]

which climbed 2.49% to close at R20.62, as well as Fortress REIT [JSE:FFB]

which gained 2.73% to close at R12.05.

Retailer Truworths [JSE:TRU] advanced 2.6%

to close at R74.90, financial services provider Old Mutual gained 0.79%

to close at R21.79, and Mediclinic [JSE:MEI] rose 2.57% to close at R56.36.

Steinhoff International [JSE:SNH] fell

mainly on the back of the release of its 2018 annual report which highlighted

significant losses.

The stock eventually closed 8.67% lower at

R1.37. Miners remained subdued with losses being recorded for Impala Platinum

[JSE:IMP] which lost 2.63% to close at R67.50, Kumba Iron Ore [JSE:KIO] fell

2.3% to R473.74, and Sibanye Stillwater [JSE:SGL] closed 1.89% weaker at

R14.53.

Index heavyweight Naspers [JSE:NPN] dropped

1.48% to close at R3464.16, while diversified mining giant Anglo American PLC

[JSE:AGL] closed at R387.88 after falling 1.15%.

The JSE All-Share index eventually closed

0.13% lower while the blue-chip JSE Top-40 index dropped 0.11%.

The Financials recorded another buoyant

session as it climbed 1.29%, however the Resources and Industrials lost 0.62%

and 0.38% respectively.

Brent crude was steady in today’s session

following the prior session’s surge. The commodity was trading 0.1% firmer at

$62.17/barrel just after the JSE close.

At 17:00, Gold was 0.17% weaker at

$1344.35/oz, Palladium was 0.96% firmer at $1497.45/oz, and Platinum had shed

0.17% to trade at $1344.35/oz.

[ad_2]

Source link