LATEST FINANCIAL NEWS

Testing higher subscription cost in Sweden

Spotify is planning to test a price increase for family plan subscribers in Scandinavia to see whether it can raise prices in the region and around the world, according to a Thursday report from Bloomberg. The family plan in Sweden currently costs about 149 Swedish krona ($15.45) per month, similar to the pricing in the United States and the rest of Europe. The new pricing will be about a 13% increase.

The company is looking to maximize its revenue in markets where it’s already a dominant force in music while expanding at lower prices into emerging markets in Asia and the rest of the world. It makes sense for the Swedish company to see if it can successfully raise prices in Scandinavia before testing other markets.

Spotify’s falling revenue per subscriber

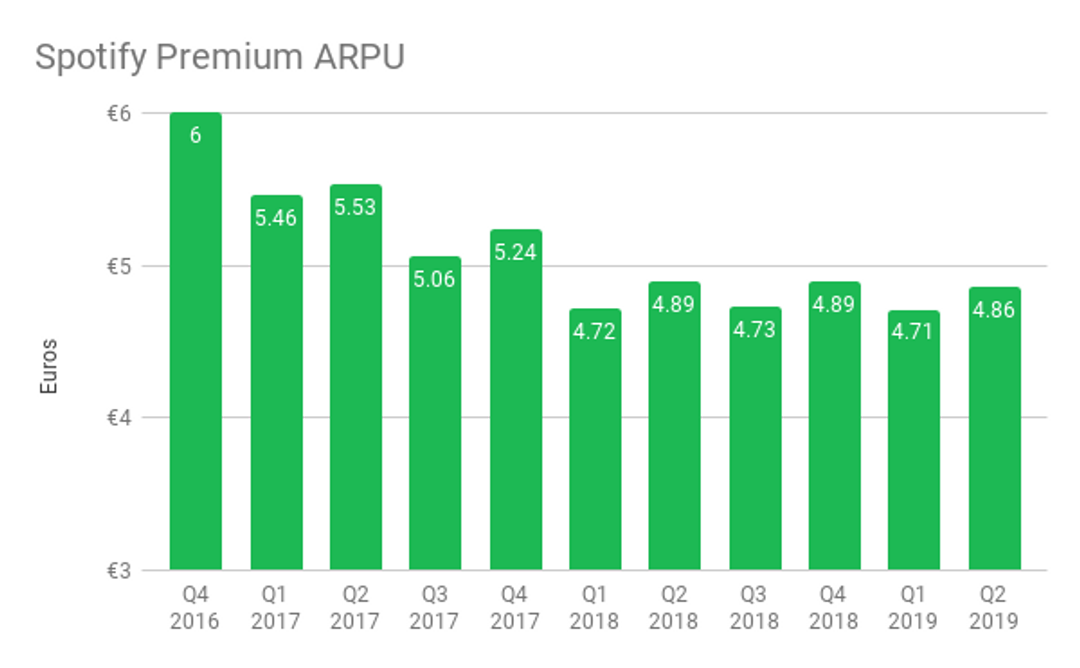

Spotify has experienced a significant decline in its average revenue per user over the last few years. The erosion coincides with its revamped family plan pricing from 2016, which made it significantly less expensive for bigger families to all get premium access. For example, a family of five could cut their Spotify bill in half with the new pricing.

While Spotify has expanded into new markets with lower average prices than in its most popular markets – Europe and North America – family plan pricing is still the biggest factor impacting the company’s average revenue per user. “Approximately 75% of the impact to ARPU is attributable to product mix changes,” management wrote in the company’s second-quarter letter to shareholders.

Petitioning: Hundreds of Google employees call for company to avoid work with ICE and CBP

Some music publishers have complained about Spotify’s declining ARPU, since a large part of their contracts include revenue-sharing agreements with the music streamer. The company is currently engaged in a round of contract renewals with the major labels, having inked deals with two of the four companies as of its second-quarter earnings release at the end of July. Stabilizing, or even increasing, ARPU will give Spotify additional leverage in the next round of negotiations, which will likely be in two years, if history is anything to go by.

Can Spotify pull it off?

Enacting a price increase is a much tougher task for Spotify than it is for a company like Netflix. Netflix has had several successful rounds of price increases over the last several years, and it’s continued to grow its subscriber base.

While Netflix faces a considerable number of competitors in streaming video, it’s been able to differentiate itself through its exclusive original series and films. Users might be able to easily cancel Netflix and switch to another streaming service, but there’s a big switching cost: no more Stranger Things (or other popular original series).

Spotify, on the other hand, has the same 50 million songs as Apple or any of its competitors in music streaming. While Spotify has worked to differentiate its products through playlists and podcasts, the switching costs aren’t nearly as high compared to the video-streaming world.

New report: Women sewing blue jeans at Levi’s, Wrangler, Lee were abused

Most importantly, however, Apple and most of Spotify’s biggest competitors can afford not to make a profit on music streaming. So, Apple’s $14.99 per month family plan probably won’t get more expensive as long as Apple sees continued loyalty and engagement with the rest of the Apple ecosystem from those customers. So, if Spotify raises prices, more consumers could flock to less expensive competitors that offer practically the same service.

Ultimately, it won’t hurt Spotify to conduct a test of higher prices in markets like Scandinavia, where it’s a dominant force. It can then at least show the data to music labels. And if the price increase actually works, then it’s a win-win for both Spotify and the labels. Importantly, labels won’t get better deals from other competitors with no interest in raising prices. Meanwhile, Spotify can focus on other sources of revenue like podcasts.

Adam Levy owns shares of Apple. The Motley Fool owns shares of and recommends Apple, Netflix, and Spotify Technology. The Motley Fool has the following options: short January 2020 $155 calls on Apple, long January 2020 $150 calls on Apple, short January 2020 $155 calls on Apple, and long January 2020 $150 calls on Apple. The Motley Fool has a disclosure policy.

The Motley Fool is a USA TODAY content partner offering financial news, analysis and commentary designed to help people take control of their financial lives. Its content is produced independently of USA TODAY.

Offer from the Motley Fool: 10 stocks we like better than Spotify Technology

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now… and Spotify Technology wasn’t one of them! That’s right – they think these 10 stocks are even better buys.

See the 10 stocks

*Stock Advisor returns as of June 1, 2019