LATEST FINANCIAL NEWS

Eskom’s turnaround imperilled as debt approaches R500 billion

[ad_1]

The embattled state power utility’s debt burden, described by Goldman Sachs as the biggest threat to the South African economy, has burgeoned, compounding the difficulty the government faces in formulating a turnaround plan.

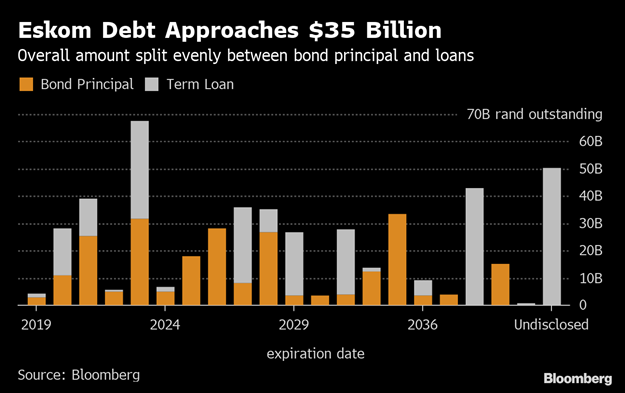

Eskom’s debt is approaching R500bn, according to data compiled by Bloomberg from public records, including bonds and issued loans, up from about R370bn a year ago. While the utility declined to comment on the current number, its chief executive officer Phakamani Hadebe last month put total debt at about R450bn.

Eskom hasn’t been selling enough power to cover its operating costs and interest payments, and has been forced to implement rotating blackouts over the past few years to prevent a collapse of the national grid as its fleet of aging and poorly maintained plants struggled to keep pace with demand.

President Cyril Ramaphosa announced plans earlier this year to split the company into three units to make it easier to manage, and the National Treasury allocated a R69bn cash injection over the next three years in the February budget – a bailout that’s already been partly offset by the rising debt.

The restructuring will allow for greater participation by private industry in the electricity industry but there are no plans to privatise Eskom, Ramaphosa said at an investor conference organised by Goldman Sachs in Johannesburg on Wednesday, his first engagement with business since he won a five-year term in May 8 elections.

”Eskom is too big to fail,” he said. ”If Eskom fails, this economy fails.”

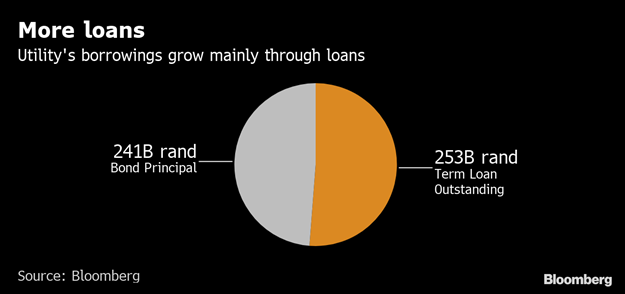

The composition of the utility’s debt has also changed, with loans accounting for just more than half of its total burden, up from 40% a year ago.

The switch to short-term financing hasn’t been smooth sailing – a loan agreed with China Development Bank failed to come through as scheduled earlier this year and Eskom had to take out an urgent R3bn bridge loan from Absa to avoid a call on existing guarantees.

Eskom bonds

Even as data shows Eskom’s debt is swelling, yields on the company’s dollar bonds ticked lower on Wednesday as investors bet the government would step in to prevent any chance of a default.

Yields on Eskom’s $1.75bn of 2021 securities dropped three basis points to 6.31%, and are trading well below the average of 7.24% over the past year. The yield is down 14 basis points since May 8, when the ANC won a majority in the elections.

[ad_2]

Source link