LATEST FINANCIAL NEWS

Everyone can apply starting later this month

[ad_1]

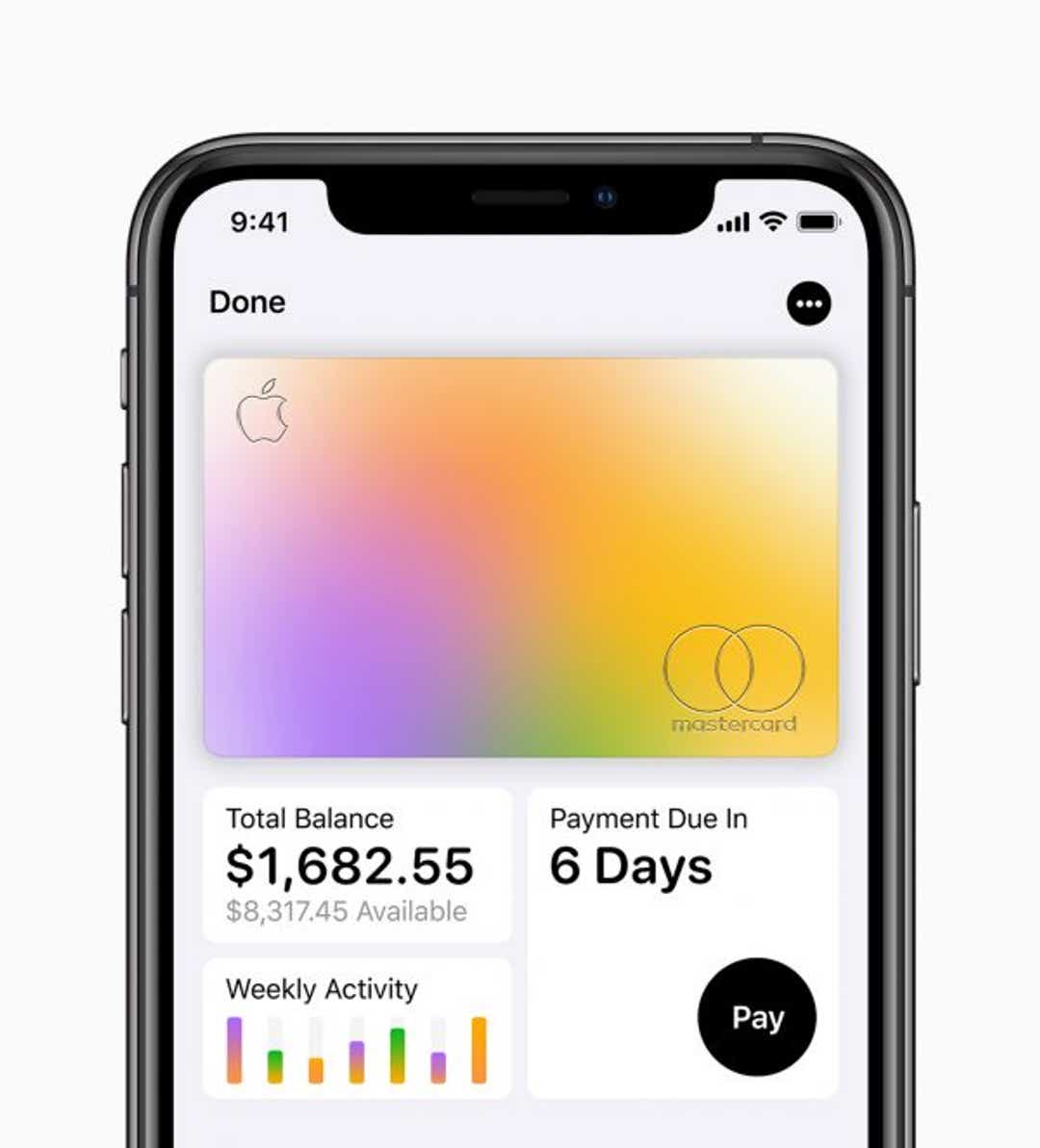

The new Apple Card is here – at least for a select few.

Apple is inviting a limited number of people to apply for the card in an email it’s sending Tuesday. These are people who had expressed interest in the product when it was first announced last spring. Everyone else will have a chance to apply for the card in the Apple Wallet app later this month, although no specific date was provided.

The tech company didn’t disclose how many people will receive Tuesday’s special invitation.

The sleek number-less titanium card that integrates with Apple Pay, the company’s digital wallet, was announced in March. Goldman Sachs is the issuer behind the Apple Card and will decide whether an applicant has the proper creditworthiness for approval.

You’ll be notified right away. If approved, you can start using the card through Apple Pay on your phone (or Apple Watch) immediately; it’s up to you whether you want to request the physical card.

The card also uses the Mastercard network, so you can use the card almost everywhere in the world.

The Apple Card in detail

The Apple Card also has no fees. None for foreign transactions, going over your limit, cash advances or late payments. There are other cards that don’t charge some of these fees. But having no fee for cash advances or late payments is uncommon.

The card’s interest rate is broad – between 12.99% and 23.99% and also based on Goldman’s determination of your creditworthiness – but it largely lines up with other credit cards. You will need an iPhone and must update your device to iOS 12.4 software.

The card is for a single user; you cannot share an account with your family, say.

Earn more: 55% of Americans want a side hustle: Here’s how to start

Don’t do this: 90% of Americans regret making this money mistake

The Apple Card also comes with rewards. You earn 3% back on Apple purchases, 2% back when you use the card with Apple Pay, and 1% back when you use the physical card. Comparing strictly by rewards, it’s not the richest among rewards cards. Others could earn you more on your everyday spending.

You also don’t have to wait to earn a certain amount of rewards before redeeming them. The rewards you earn are added to your Apple Cash card every day and can be used for any amount at any time. You can also schedule payments.

Is Apple card more secure?

Apple also touts the card’s security features. For instance, the card itself has no numbers on it, so a criminal can’t copy your card’s number and create a fake. While that is helpful, the incidence of counterfeit fraud is declining in the U.S., thanks to the widespread adoption of chip cards.

The card also benefits from Apple Wallet’s built-in security that generates a token number with every transaction, so that the card number is not associated with a purchase. If a thief picks up the token, it’s meaningless and can’t be used for an unauthorized purchase. But, this security is offered to all credit cards stored on Apple Pay and not just limited to the Apple Card.

If you detect a mistake or believe you were erroneously charged, you can make a claim directly in the Wallet app on your phone. You can also lock the card within the app, and if need be place a call to customer support.

But even if you lose the physical card or it is stolen, you can continue to make payments through the phone.

Apple Card as a budget tool

The Apple card also comes with a money management tool. It color-codes your purchases on your iPhone, so you can keep tabs on how much you’re spending on dining out, gas and groceries among other categories. You cannot choose how expenses are categorized.

You can see real-time views of your latest transactions, in some cases with the merchant’s location plotted on a map.

Merger alert: GateHouse Media owner to acquire USA TODAY owner Gannett

Another interesting feature is a tool that shows how much you will pay in interest depending on the size of the payment you send in each month. Apple may also nudge you within the Wallet app to pay more than the minimum sum due to pay off your outstanding balance sooner.

This can be a useful tool for budget-minded Americans who want to carefully manage their expenses while maintaining a good credit history. But like with any credit card, it’s important to shop around for the one that works best for your spending habits.

[ad_2]

Source link